Frankfort 157-C Faces Steep Insurance Hikes, Projects $5.5 Million Cost for 2026

Frankfort School District 157-C Meeting | October 2025

Article Summary: Frankfort School District 157-C is bracing for significant increases in employee insurance costs for 2026, with an anticipated 18.6% rise in medical premiums and a 17% increase for dental plans. The administration has proposed plan structure changes to help mitigate the impact on the district’s budget, which projects an overall insurance cost of approximately $5.5 million.

2026 Insurance Renewal Key Points:

-

Medical insurance premiums are expected to increase by 18.6%, and dental by 17%.

-

The district’s total projected cost for employee insurance in 2026 is $5.5 million, up from about $5 million in the previous year.

-

The board approved changes to two of its five PPO plans, creating Tier 1 and Tier 2 networks and adding a new hospital stay option.

-

The administration will explore other brokers and co-op options after board members questioned if there were more cost-effective alternatives.

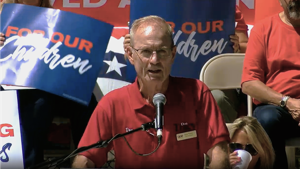

The Frankfort School District 157-C Board of Education on Tuesday, October 21, 2025, approved changes to its employee health insurance plans for 2026 in response to steep premium increases from its carriers.

Director of Human Resources Shayna Cole reported that the district is anticipating an 18.6% increase for medical insurance, a 17% increase for dental, and a 5% increase for vision plans. The overall projected cost for the district’s employee insurance program in 2026 is approximately $5.5 million, a half-million dollar increase from the prior year.

To manage the rising costs, the board approved a recommendation from its insurance broker, Stumm Insurance, to modify two of its five current medical PPO plans. The changes will introduce Tier 1 and Tier 2 provider networks and offer a new hospital stay option for staff to choose from.

During the discussion, board member Brian Skibinski asked if the district was exploring other options, such as different brokers or joining a cooperative, to combat the increased costs. Ms. Cole stated that it was “worth it to explore options” and that she would look into all factors.

Superintendent Dr. Doug Wernet added that due to the performance of past claims, BlueCross BlueShield was the only company that would currently accept the district. He assured the board that the administration would be transparent and investigate other brokers and options while being mindful of the financial impact on employees. The board voted 7-0 to approve the proposed plan changes.

Community Events

Latest News Stories

Governor defends mental health mandate, rejects parental consent plan

Major U.S. retailer reverses course on tariffs, says prices will go up

Illinois quick hits: Arlington Heights trustees pass grocery tax

Plan launched to place redistricting amendment before voters in 2026

Illinois GOP U.S. Senate candidates point to economy, Trump gains

Executive Committee Details Spending of $134 Million in Pandemic Relief Funds

Lawmaker criticizes $500 student board scholarships amid lowered K‑12 standards

Illinois news in brief: Work begins on $1.5 billion O’Hare expansion; Police catch man accused of road rage, shooting

Soaring utility bills, solar federal tax credit cuts dominate Illinois energy debate

Illinois quick hits: Pritzker signs crypto regulations

Trucking industry leader: New law may drive business out of Illinois

Derailment disrupts train service for Chicago, New York, Washington, Miami

Democratic candidates focus on national politics in campaign for U.S. Senate

Chicago posts fewest homicides since 2016, arrests rate also declines