Frankfort 157-C Board Directs Administration to Pursue 4.39% Tax Levy Increase

Frankfort School District 157-C Meeting | October 2025

Article Summary: The Frankfort School District 157-C Board of Education on Tuesday directed its administration to prepare a 2025 property tax levy proposal representing a 4.39% increase over the previous year’s extension. The decision came after a detailed presentation on the district’s financial outlook, which includes projections for rising property values and steady enrollment.

Preliminary Tax Levy Key Points:

-

The board considered three levy options with increases of 4.00%, 4.39%, and 4.93% over the 2024 tax extension.

-

Following discussion, Board President Edith Lutz directed the administration to proceed with the 4.39% option for further development.

-

The district’s total Equalized Assessed Value (EAV) is projected to grow by 7% to approximately $1.4 billion for 2025.

-

The levy process will continue in November, with a public hearing and final adoption of the levy scheduled for the December board meeting.

The Frankfort School District 157-C Board of Education on Tuesday, October 21, 2025, signaled its preference for a tax levy increase of 4.39% for the 2025 tax year.

During a preliminary discussion, Director of Business and Operations Dr. LeeAnn Taylor presented the board with three potential levy options, reflecting increases of 4.00%, 4.39%, and 4.93% over the 2024 extension of $39.9 million. These options were based on various assumptions for new property growth in the district.

Dr. Taylor explained that the levy is the annual process by which the district requests the funds needed to operate, with local property taxes accounting for approximately 93.5% of its total revenue. The final amount the district actually receives, known as the extension, is determined by factors including the Consumer Price Index (CPI), new property growth, and the area’s Equalized Assessed Value (EAV).

For the 2025 levy, the applicable CPI is 2.9%. The district’s total EAV is estimated to be $1.4 billion, a 7% increase from 2024. Dr. Taylor noted the district’s EAV has grown by approximately 38% since 2022.

The presentation outlined several levy scenarios based on different estimates for new property value, ranging from an initial projection of $15.37 million to a “ballooned” estimate of $60 million to capture all potential growth. The three options presented to the board were based on new property assumptions of $15.6 million, $20 million, and $60 million, respectively.

After board member Brian Skibinski inquired about the risks of requesting a lower amount and potentially not capturing all new growth, the board engaged in further discussion. Ultimately, Board President Edith Lutz gave direction to the administration to prepare a levy based on the 4.39% increase for the next meeting.

The administration will formally present the calculated levy in November, at which point the board will set a date for a public hearing. The final levy is scheduled for adoption at the December board meeting.

Community Events

Latest News Stories

Will County Animal Protection Services Seeks New Facility Amid “Gaping Wound” of Space Crisis

Board Confronts Animal Services Crowding, Explores Future Facility Options

Will County Board Members Demand Transparency in Cannabis Tax Fund Allocation

Homer Glenn Residents Push Back on 143rd Street Widening as Officials Signal “Tentative Agreement”

Will County Forges 2026 Federal Agenda Amid D.C. Policy Shifts, ‘Big Beautiful Bill’ Impacts

Health Department Seeks $1 Million Levy Increase to Prevent “Weakened System”

County Rolls Out New “OneMeeting” Software to Improve Public Access

Meeting Summary and Briefs: Will County Board Finance Committee for August 5, 2025

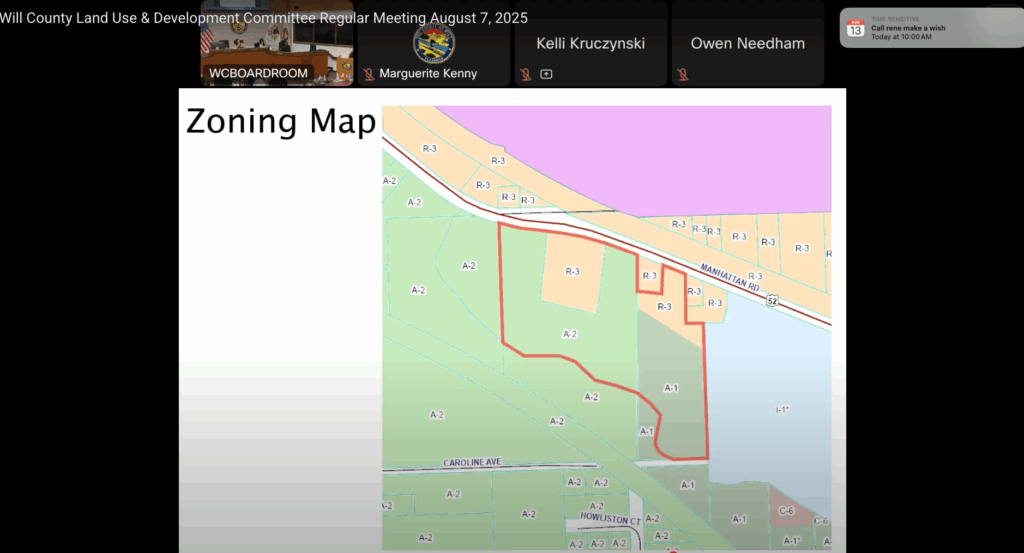

Will County PZC Approves Rezoning for Truck Repair Facility on Manhattan Road Amid Resident Concerns

Key Stretch of Bell Road on Track for Thanksgiving Reopening, Committee Approves Additional Funds

Will County Leglislative Committee Opposes Federal Push for Heavier, Longer Trucks

Will County Reports Progress in Opioid Fight, Highlights New FDA Labeling Rules