Frankfort Square Park District Board Approves 25% Increase in Proposed Tax Levy

Frankfort Square Park District Meeting | October 16, 2025

Article Summary: The Frankfort Square Park District Board of Commissioners on Thursday approved a resolution estimating a 25% increase in its total property tax levy for 2025, a move officials say is designed to capture revenue from new commercial growth without raising taxes for existing residents.

Truth in Taxation Key Points:

-

The total proposed property tax levy for 2025 is estimated at $5,838,966, a 25% increase from the 2024 extension of $4,688,673.

-

Officials describe the proposal as a “balloon levy” intended to capture new tax revenue from anticipated commercial development, particularly in Tinley Park.

-

Because the proposed increase exceeds 5%, the district is required to hold a public hearing, which has been scheduled for December 1, 2025.

-

The final tax amount the district receives cannot exceed legal limits and will be determined by the final Equalized Assessed Valuation (EAV) and new growth figures.

The Frankfort Square Park District Board of Commissioners on Thursday, October 16, 2025, unanimously approved a resolution for its 2025 property tax levy, estimating a 25% increase over the previous year’s extension.

According to Resolution 25-10-53, the district’s total estimated property taxes to be levied for 2025 are $5,838,966, compared to the $4,688,673 extended in 2024. The largest portion of the increase comes from corporate and special purpose taxes, which are proposed to rise by 26% from $4,442,080 to $5,592,379.

In a report to the board, Executive Director Audrey Marcquenski explained the strategy behind the significant increase, calling it a “balloon levy” designed to capture new growth. The report specifically cited proposed commercial development in Tinley Park that would increase the park district’s Equalized Assessed Valuation (EAV). By estimating a higher levy, the district positions itself to collect tax dollars from new properties added to the tax rolls without this cost being passed on to current taxpayers.

“Without inflating the levy in this manner, we could lose the tax dollars provided by any new growth,” Marcquenski stated in the report.

Under Illinois’s Truth in Taxation Law, a public hearing is required if a proposed levy is more than 105% of the previous year’s extension. The board has scheduled the required public hearing on the proposed levy for December 1, 2025.

Officials noted that the final tax amount the district receives is subject to statutory limits. Even if the estimated levy is higher than what can be collected, the district will only receive what is established by the final EAV and new growth calculations.

The resolution was adopted by a 4-0 vote, with President Craig Maksymiak and Commissioners Phil Cherry, Frank Florentine, and Denis Moore voting in favor. Commissioners Lauren Breedlove, Ryan Holley, and Joseph King were absent.

Community Events

Latest News Stories

D.C. attorney general sues Trump administration, claiming ‘unlawful’ takeover

What’s on the table for Trump’s meeting with Putin?

WATCH: Illinois In Focus Daily | Friday Aug. 15th, 2025

Federal government to drop 300,000 workers this year

Illinois quick hits: Ex-student sentenced for school gun, time served; fall semester beginning

Report Finding Few Trucks Littering Sparks Debate on Cleanup Responsibility

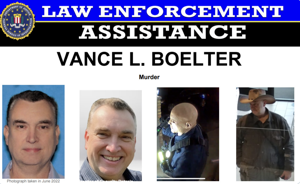

Grand jury indicts accused killer of Minnesota lawmaker

Sailors return to San Diego after extended Navy deployment

Illinois quick hits: Search continues for Gibson City suspect; manufacturing declines since 2000

Vance praises troops as backbone of Trump’s peace campaign

Trump orders drug stockpile, increased manufacturing

WATCH: Map debate, case against Texas Democrats continues in Illinois