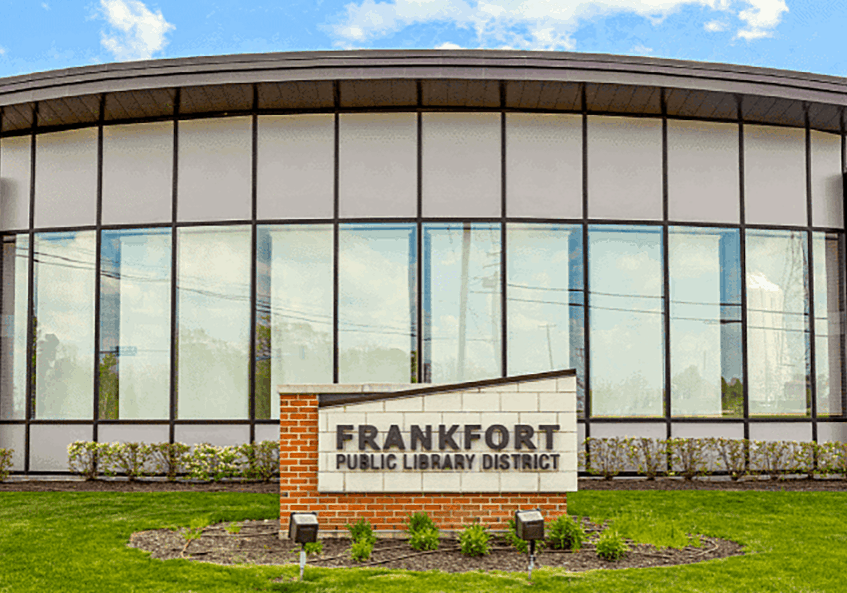

Frankfort Library Board Approves 2025 Tax Levies

Frankfort Public Library District Meeting | September 2025

Article Summary: The Frankfort Public Library District Board of Trustees has unanimously approved its 2025 tax levy ordinance and a separate building maintenance tax levy. These annual measures are necessary to generate the property tax revenue required to fund the library’s operations, materials, and upkeep for the coming year.

Frankfort Public Library Board Key Points:

-

The board unanimously approved the 2025 Tax Levy Ordinance following a roll call vote.

-

A separate Building Maintenance Tax Ordinance was also passed to create a dedicated fund for the upkeep of the library facilities.

-

The maintenance levy is calculated separately from the general levy, ensuring taxes collected for this purpose are specifically awarded to that fund.

-

Both measures passed with a 7-0 vote from all trustees present at the meeting.

The Frankfort Public Library District Board of Trustees on Thursday, September 25, 2025, unanimously approved the tax levies that will determine a significant portion of its funding for the upcoming fiscal year.

In two separate roll call votes, the board passed the 2025 Tax Levy Ordinance and the Library Building Maintenance Tax Ordinance. These ordinances are critical procedural steps that allow the library to request and collect property tax revenue from residents within the district’s boundaries. The funds support everything from book purchasing and programming to staffing and facility operations.

The first measure, the general 2025 Tax Levy Ordinance, was approved following a motion by Trustee Otway and a second by Trustee Faris. The motion passed with unanimous support from all seven trustees present: President Look, and Trustees Miner, Meszaros, Otway, Faris, Evenhouse, and Stenoish.

Immediately following, the board took up the Building Maintenance Tax Ordinance. Trustee Meszaros made the motion to approve the levy, which was seconded by Trustee Miner. According to the meeting minutes, this levy is “calculated separately from the overall Tax Levy, due to the Library having a separate fund for maintenance that the taxes collected will be awarded to.” This ensures that funds intended for the upkeep and repair of the library building are specifically allocated for that purpose and not absorbed into the general operating budget. This measure also passed with a unanimous 7-0 vote.

The approval of the tax levies is an annual responsibility of the library board. The specific tax rates and the impact on individual property tax bills will be determined later by the county clerk’s office, based on the total equalized assessed valuation of property within the library district.

During the treasurer’s report for August, Trustee Miner noted the library’s sound financial position, stating that expenses are currently running 3% under budget. It was also reported that a transfer of excess budget from the 2024-2025 fiscal year to the Special Reserve budget was completed, bringing that reserve balance to $664,402.

Latest News Stories

Better-than-expected inflation report generates cut predictions

Op-Ed: 340B needs transparency to fulfill Its mission

India’s Reliance says it will abide with sanctions on Russian oil purchases

Critics warn Illinois’ ‘megaproject’ tax breaks shift costs to taxpayers

WATCH: Pritzker creates accountability commission amid increased immigration enforcement

Illinois quick hits: Report: $17,300 state debt per person; Metro East crime suppression operations

Trump suspends trade talks with Canada over Ronald Reagan ad

Meeting Summary and Briefs: Lincoln-Way Community High School District 210 for October 16, 2025

WATCH: GOP leader calls Pritzker’s accountability commission a ‘political stunt’

Battery storage financials remain in question as lawmakers consider energy omnibus

Illinois quick hits: Pritzker praises credit upgrade; Cook County approves $20M quantum grant

Op-Ed: Main Street businesses, customers would bear brunt of a tax on services