WATCH: Debate around which tax to increase; pension enhancements, energy bills advance

(The Center Square) – In today’s edition of Illinois in Focus Daily, The Center Square Editor Greg Bishop reviews the ongoing debate at the Illinois Statehouse about which taxes to increase during the final days of fall veto session. Among the proposals are an “amusement tax,” a retail delivery tax and decoupling Illinois tax code from the federal tax code.

Bishop also reviews several measures advancing through the legislature, including a pension reform measure that passed an Illinois House committee and an energy measure focused on renewables that passed the Illinois House. Both chambers are in session for the final day of veto session Thursday.

Subscribe to Illinois in Focus Daily with The Center Square on YouTube. You can also subscribe to the Illinois in Focus podcast to get the entire show uninterrupted.

Latest News Stories

Meeting Summary and Briefs: Frankfort Public Library District for August 28, 2025

Meeting Summary and Briefs: Frankfort Fire Protection District Board of Trustees for August 19, 2025

Frankfort Library Approves Funds for New Heaters, Tree Removal

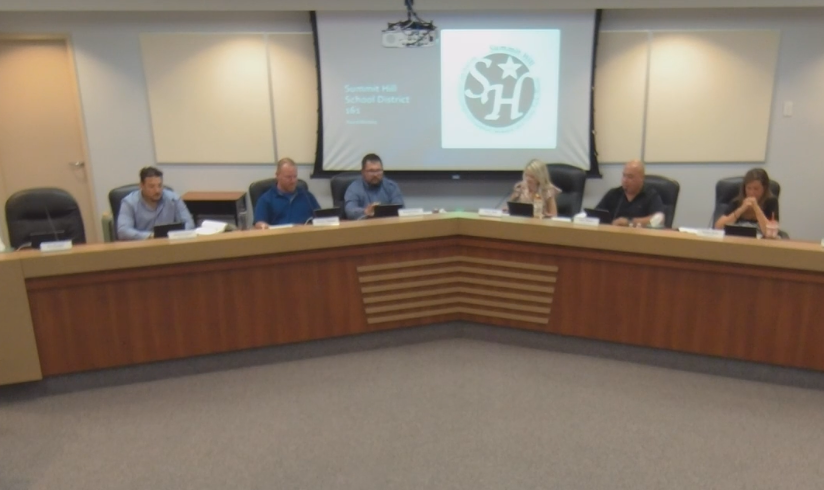

Summit Hill 161 Welcomes Will County Sheriff’s Deputy as New School Resource Officer

Meeting Summary and Briefs: Frankfort Square Park District for August 21, 2025

Frankfort Fire Board Adopts FY 2026 Budget Amid Rising Insurance Costs

Meeting Summary and Briefs: Will County Board for September 18, 2025

Library Approves $14,700 for Reading Room Architectural Services

Meeting Summary and Briefs: Frankfort Township Board for August 11, 2025

Summit Hill 161 Board Approves $40 Million Budget for 2025-2026 School Year

Meeting Summary and Briefs: Lincoln-Way Community High School District 210 Board of Education for September 18, 2025

LWSRA Details Services for Residents with Disabilities, Plans ‘Hero Village’ Grand Opening

JJC Moves Forward with Major Technology Overhaul to Modernize College Operations

Meeting Summary and Briefs: Frankfort Park District for August 12, 2025