Critics warn Illinois’ ‘megaproject’ tax breaks shift costs to taxpayers

(The Center Square) – A Springfield proposal grants major tax breaks to “megaprojects,” which critics warn could leave homeowners and small businesses paying the price.

House Bill 4058, which mirrors similar proposals in the Senate, has drawn sharp criticism from taxpayer advocates, like Brian Costin, deputy state director at Americans for Prosperity Illinois. Costin said the measure opens the door for politically connected developers to benefit at public expense.

“This is Gov. [J.B.] Pritzker’s property tax hike,” said Costin. “He is trying to raise property taxes on the regular folks of Illinois to reward millionaires and billionaires.”

The bill began as a local concept in Arlington Heights for a professional football stadium, but Costin said it has grown far beyond that. Costin said HB 4058 appears to be the governor’s preferred version of the legislation, pointing to recent media efforts by administration allies.

“They’ve kind of been putting a press push out with his Illinois Economic Development Corporation chairman,” Costin said. “Pritzker appointee, John Atkinson, wrote an editorial in the [Chicago] Tribune, and my editorial was kind of in response to that. I don’t think they would’ve let him write that unless it had the governor’s approval.”

In simple terms: the bill lowers the minimum size for a “megaproject” from $500 million to $100 million, meaning smaller projects can now get the same huge tax breaks. Costin warns this lets more developers take advantage of the program, while regular homeowners and local businesses end up paying more in taxes to cover the difference.

“The way the bill actually works is that megaproject property taxes are frozen for 23 to 40 years at their pre-development level,” Costin explained. “At the same time, all the overlapping taxing bodies can still raise their property tax levies as if the developer were paying full taxes on the property’s new value. That means every dollar in tax relief for the developer gets shifted onto taxpayers outside the megaproject area.”

Costin said the measure’s special payment provision lets local governments collect as if big developments paid full property taxes, even though the projects get decades-long tax breaks.

“There’s a special payment provision that says, ‘We’ll give you this special payment if you give us a massive property tax break,’” Costin said. “All of the local taxing bodies can still raise their property tax levies as if the megaproject were paying in full, plus they get this special payment. So they’re financially held harmless — and taxpayers outside the district are the ones who pay for it.”

Costin raised additional concerns about constitutional issues, Illinois’ “uniformity clause.”

“That clause requires people to be taxed and assessed uniformly,” Costin explained. “But this bill creates a whole different set of rules for politically favored projects. It’s interesting that they’re acknowledging potential constitutional problems before the bill even passes.”

While supporters argue the bill could create jobs, Costin cautioned that those benefits may be overstated.

“Lower property taxes do bring jobs and economic opportunity,” he said. “But this isn’t really a property tax relief bill, it’s a property tax shift. Whatever benefits there are for developers are offset by the fact that taxpayers elsewhere are paying more to make it happen.”

He also warned that developers often leverage such incentives to build their portfolios rather than invest locally.

“A lot of times, these developers come in, get a nice subsidy, build it out, and then leave,” he said. “The long-term promises are mixed at best.”

Latest News Stories

Illinois treasurer promises to pass nonprofit legislation vetoed by Pritzker

Regional Office of Education Highlights School Safety, New Learning Programs in Update

Fort Frankfort Playground Grand Opening Delayed Until Spring 2026

Lincoln-Way to Purchase New Buses, Add Smaller Vehicles to Address Driver Shortage

Will County Awards $10.4 Million Contract for Bell Road Widening Project

Green Garden’s Wildflower Farm Granted Second Extension for Rural Events Permit

Summit Hill 161 Board Approves Longevity Pay Bumps for Non-Certified Staff

Meeting Summary and Briefs: Village of Frankfort Board for October 6, 2025

Will County Board Compromises on Mental Health Levy, Approves $10 Million After Debate

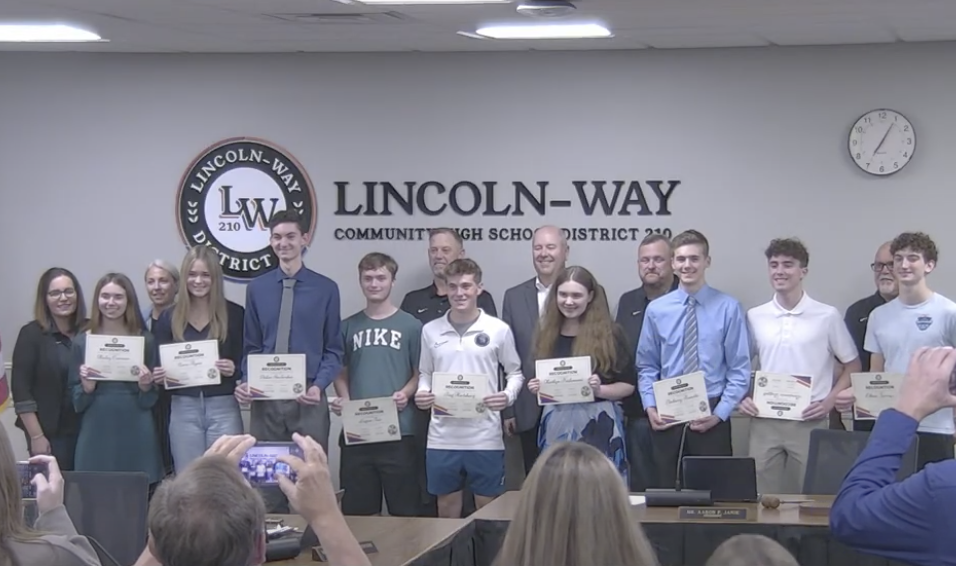

Lincoln-Way Board Honors Students with Perfect ACT Scores, Music Educator of the Year

Frankfort Township Board Denies Permit for New Bar on St. Francis Road

Summit Hill 161 Explores Switch to MacBooks for Teachers, Plans Pilot Program