Manufacturing advocate: ‘Follow the actions’ with Pritzker on taxes

(The Center Square) – Gov. J.B. Pritzker says he prefers growing the economy over raising taxes, but a small and midsize manufacturers’ advocate says the governor’s actions don’t follow his words.

The governor suggested last week that the General Assembly could undo tax benefits provided by the federal government’s One Big Beautiful Bill Act in order to fill a projected $267 million state deficit.

On Tuesday, Pritzker said he preferred economic growth over cutting spending or raising taxes.

“You’ve got to balance the budget. There’s no doubt about it. I prefer growing the economy to the other two methods,” Pritzker told The Economic Club of Chicago.

David Curtin, a Springfield lobbyist for the Schaumburg-based Technology and Manufacturing Association, said the governor uses the right words.

“If you follow the actions, this action would not follow those words, but he would wordsmith it in some other way,” Curtin told The Center Square.

Curtin said Pritzker wants to get rid of the Big Beautiful Bill provision giving manufacturers a 100% bonus depreciation of equipment and machinery in the first year.

“That would help manufacturers quite a bit, and manufacturers will realize that this year. It’ll go into effect because Illinois is automatically tethered to the federal law, unless the legislature does something about it and cuts us out of the process,” Curtin explained.

The Governor’s Office of Management and Budget released the annual Illinois Economic and Fiscal Policy Report on Oct. 9.

“GOMB projects that H.R. 1’s negative impact on business tax collections will outweigh these gains. General Funds revenues are now projected to be net $449 million lower than earlier estimates due to an estimated $830 million reduction in state tax revenue in FY2026 due largely to automatic state tax law conformity with federal corporate tax cuts,” the governor’s press release accompanying the report noted.

Curtin said other states are welcoming the federal government’s tax benefits because they help manufacturers grow and invest.

William McBride, chief economist and Stephen J. Entin Fellow in Economics at the Tax Foundation, said the Big Beautiful Bill’s depreciation provision allows immediate write-offs aimed at manufacturing and production. In the past, McBride said businesses could wait as long as 39 years to write off investments in structures like factories.

“A manufacturing business has to have a manufacturing facility, or they’re not a manufacturing business” McBride said. “They have to lay out the millions of dollars to build that facility. That’s core to their business.”

McBride said the provision helps cut the inflation risk out of businesses’ tax liabilities and helps offset the cost of waiting to get deductions.

“The time value of money and inflation mean this is very much going to be an incentive for businesses to invest in particular in factories and manufacturing facilities,” the Tax Foundation economist explained.

McBride said the provision is not a carve-out.

“Think about this as just righting a wrong that has existed in the tax code since the beginning of the income tax. That’s the way I would characterize it. I would absolutely not characterize it as a carve-out,” McBride said.

McBride said Illinois would be at a competitive disadvantage if it did not conform to the federal law.

Latest News Stories

County Rolls Out New “OneMeeting” Software to Improve Public Access

Meeting Summary and Briefs: Will County Board Finance Committee for August 5, 2025

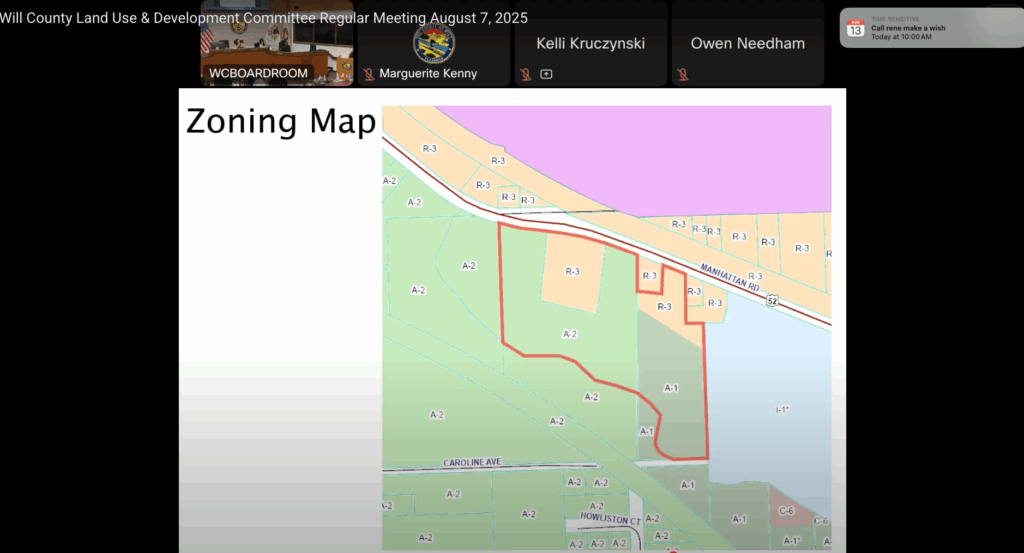

Will County PZC Approves Rezoning for Truck Repair Facility on Manhattan Road Amid Resident Concerns

Key Stretch of Bell Road on Track for Thanksgiving Reopening, Committee Approves Additional Funds

Will County Leglislative Committee Opposes Federal Push for Heavier, Longer Trucks

Will County Reports Progress in Opioid Fight, Highlights New FDA Labeling Rules

In-House Staff Completes Major Renovations at Will County Adult Detention Facility

Will County Advances Truck Repair Facility Plan on Manhattan Road Despite Resident Objections

PZC Grants Variance for Oversized Garage in Joliet Township, Reversing Staff Recommendation

Will County Public Works Committee Approves Over $1.1 Million in New Agreements for 80th Avenue Project

Meeting Summary and Briefs: Will County Board Legislative Committee for August 5, 2025

Meeting Summary and Briefs: Will County Board Capital Improvements & IT Committee for August 5, 2025