Report warns U.S. national debt predicted to pass $53 trillion by 2035

By fiscal year 2035, the national debt is set to surpass $53 trillion, or 120% of the nation’s Gross Domestic Product, according to a new estimate by the Committee for a Responsible Federal Budget.

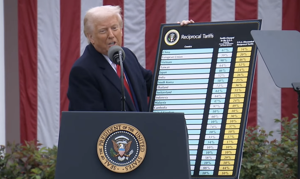

The updated number – which CRFB reached by assuming that all current trade deals and tariffs remain in effect – is $1 trillion more than projected in the Congressional Budget Office’s January 2025 Budget and Economic Outlook.

Yearly interest payments on the national debt will rise as well, climbing from nearly $1 trillion in 2025 to $1.8 trillion in 2035, a total increase of $14 trillion over the next decade. The national debt recently topped $37 trillion, as reported by The Center Square.

“The nation’s finances have deteriorated since CBO’s January 2025 budget outlook, which already showed a worrisome fiscal outlook,” CRFB stated. “[W]ith debt approaching record levels, lawmakers should proactively pursue trust fund solutions and enact a combination of revenue and spending options that put the nation’s budget on a sustainable path.”

CRFB’s report also estimates the yearly deficits will total $22.7 trillion over the next ten years – $1 trillion higher than CBO’s January estimate – rising from $1.7 trillion in 2025 to $2.6 trillion in 2035, nearly 6% of GDP.

Net government spending during that timeframe will total at least $88 trillion, partially offset by $65 trillion in revenue if current trade policy remains in place. This amounts to a net cost of $23 trillion.

CRFB says the high cost of Republicans’ “One Big Beautiful Bill Act” is partially to blame for the alarming numbers. The massive budget reconciliation bill, signed into law by President Donald Trump in July, will cost an estimated net $4.1 trillion over the next decade, mostly due to the permanent extension of most tax cuts in the 2017 Tax Cuts and Jobs Act.

Those include the boosted maximum standard deduction and cross-bracket tax cuts, the 20% Qualified Business Income deduction, and the $2,000 maximum Child Tax Credit. The bill also implemented costly temporary tax provisions, including a $6,000 deduction for eligible seniors and deductions on tips and overtime pay.

CBO has estimated that the average American household will see their resources increase because of the tax cuts, though the gains vary across income distribution. Another analysis, touted by the White House, estimates that the average taxpayer will receive a $3,752 tax cut in 2026, though the median 2026 tax cut is likely to be much lower than that.

Republicans are reportedly planning to craft a second budget reconciliation bill to implement even more of Trump’s presidential agenda. CBO and CRFB have both urged lawmakers to focus solely on implementing deficit-decreasing measures in future budget bills.

Latest News Stories

Think tank, election attorney support Trump’s vow to end mail-in voting

Frankfort Advances Plans for New Multi-Use Paths to Boost Pedestrian Safety

Pacific region sees higher inflation than national average

Frankfort Approves Over $19 Million in Surplus Fund Transfers for Future Projects

Legislative committees advance CA redistricting legislation

California schools protect students from ICE agents

White House touts D.C. crackdown; no timeline on National Guard deployment

Security clearances of 37 former, current intel professionals revoked

USDA reverses use of taxpayer dollars to fund solar panels on farmland

Governor defends mental health mandate, rejects parental consent plan

Major U.S. retailer reverses course on tariffs, says prices will go up

Illinois quick hits: Arlington Heights trustees pass grocery tax