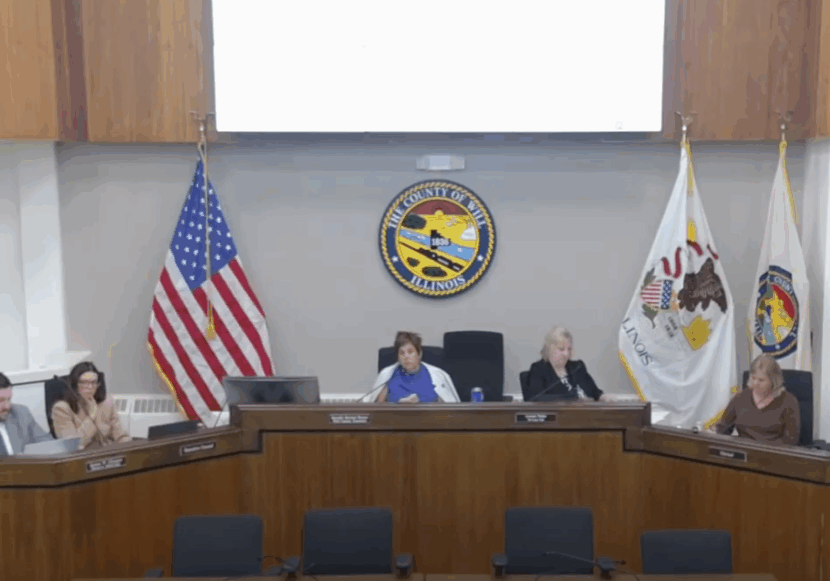

County Board Abates Over $25 Million in Property Taxes for Bond Payments

Article Summary: Will County property taxpayers will be spared over $25 million in taxes for the 2026 payment year after the County Board voted to abate taxes for six separate general obligation bonds. The board will instead use other county revenue sources to make the debt service payments, a common fiscal practice that avoids a direct levy on property owners.

Tax Abatement Key Points:

-

Total Abated: The board voted to abate a total of $25,417,449 in property taxes.

-

Action: The funds will be used to pay debt service on six different series of general obligation bonds issued between 2010 and 2021.

-

Funding Source: The debt payments will now be made from other available county revenue sources instead of a direct property tax levy.

JOLIET — The Will County Board took formal action Thursday to prevent a multi-million-dollar increase in the county’s property tax levy for the upcoming fiscal year. The board unanimously approved six separate ordinances to abate, or cancel, more than $25.4 million in taxes intended to pay debt service on general obligation bonds.

The routine fiscal measure ensures that payments on the county’s debt are made from existing revenue sources—such as sales tax or facility revenue—rather than a direct property tax levy. This prevents the cost of the bond payments from being passed on to property owners.

Finance Committee Chair Sherry Newquist presented the items as part of the committee’s consent agenda, which passed without opposition.

The abatements include:

-

$7.53 million for the Series 2010 Transportation Improvement Bonds.

-

$4.92 million for the Series 2015A General Obligation Refunding Bonds.

-

$4.40 million for the Series 2016 General Obligation Building Will Bonds.

-

$2.62 million for the Series 2019 General Obligation Building Will Bonds.

-

$5.95 million for the Series 2020 General Obligation Refunding Bonds.

-

$4.62 million for the Series 2021 Renewable Natural Gas Facility Bonds.

By approving the abatements, the board formally directs the County Clerk to cancel the tax levies associated with these bonds for the 2025 tax levy year, which is payable in 2026.

Latest News Stories

Lincoln-Way 210 to Launch District Literacy Plan, Expands Community Partnerships

Frankfort Library Board Approves FY 2025-26 Budget, Transfers $300,000 to Reserve Fund

County Board Abates Over $25 Million in Property Taxes for Bond Payments

Lincoln-Way 210 Prepares for “Retirement Wave” with Focus on Recruitment

Meeting Summary and Briefs: Frankfort School District 157-C for August 12, 2025

Frankfort Square Park District Receives Clean Bill of Health in Annual Financial Audit

Frankfort Highway Department Plans Levy Increase to Replace Aging Trucks

Lincoln-Way Board Weighs Community Solar Program Promising $155,000 in Annual Savings

Will County Reverses Zoning on Peotone Farmland to Facilitate 10-Acre Sale

Everyday Economics: Jobs, Waller and whether the Fed can thread the needle

Attack at Michigan church leaves multiple casualties

Frankfort Township Board Grants Supervisor Authority to Negotiate Real Property Development

What happens if the government shuts down?