Frankfort to Implement 1% Grocery Tax, Replacing State Levy to Preserve Revenue

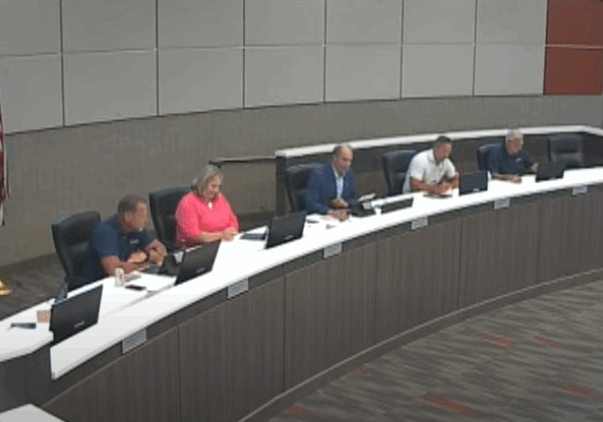

FRANKFORT – Frankfort residents will see no change at the grocery checkout line, but the village will preserve a key revenue stream after the Village Board approved an ordinance Monday to establish a 1% local tax on groceries, effective January 1, 2026.

The move is a direct response to the State of Illinois’s decision to repeal its 1% statewide sales tax on groceries as part of the Fiscal Year 2025 budget. The new legislation allows municipalities to implement their own 1% locally imposed tax to replace the lost revenue.

Trustee Eugene Savaria, who presented the ordinance, emphasized that the measure is not a new tax on consumers but a mechanism to retain existing funds.

“The proposed ordinance is not intended to impose any new tax beyond what consumers are currently paying,” Savaria said during the meeting. “Rather, it ensures that the village retains the existing revenue currently collected under the state’s grocery tax once the state eliminates its collections.”

For years, municipalities across Illinois have received a portion of the state-collected 1% tax on groceries. With the state tax set to expire, local governments faced a potential budget shortfall without the authority to replace it. The new law provides that authority, and Frankfort has joined other municipalities in acting to prevent a loss of funds.

The ordinance implements two separate but related taxes: the Municipal Grocery Retailers’ Occupation Tax and the Municipal Grocery Service Occupation Tax. This structure is required by state law to cover all applicable grocery sales and services within the village.

The Illinois Department of Revenue will continue to administer, collect, and enforce the tax on behalf of the village, ensuring a seamless transition from the state-levied tax to the local one. The ordinance required the Village Clerk to file a certified copy with the state’s Department of Revenue on or before October 1, 2025, to ensure the tax takes effect at the beginning of 2026.

The Village Board waived the first and second readings to pass the ordinance, indicating a consensus on the necessity of the action. The vote was unanimous among the trustees present.

Village officials believe adopting the ordinance is an appropriate and necessary step to maintain fiscal stability. The revenue collected is used to fund essential village services.

The ordinance will officially take effect on January 1, 2026, coinciding with the repeal of the state’s tax.

Latest News Stories

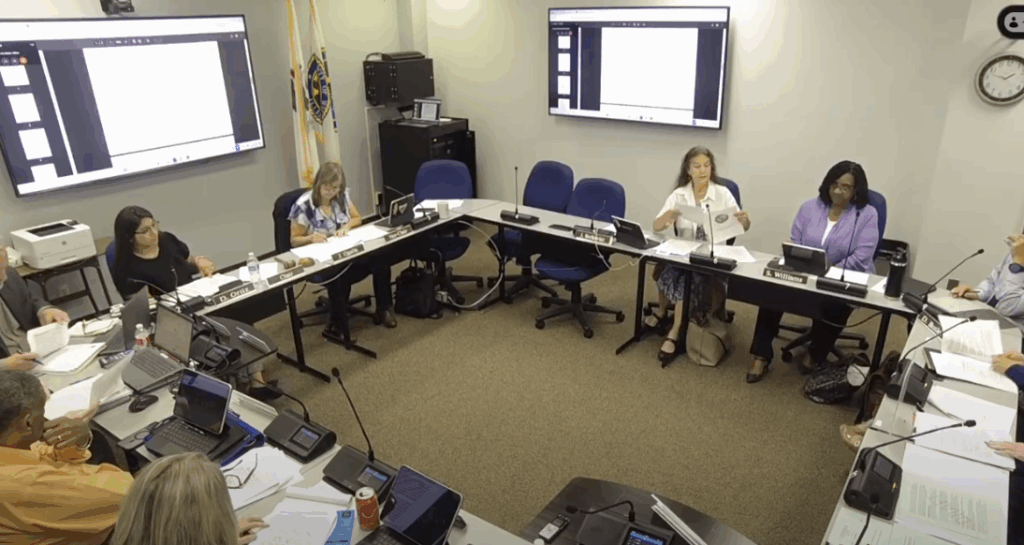

Lincoln-Way Support Staff Union Rejects Tentative Contract Agreement

Meeting Summary and Briefs: Will County Board Legislative Committee for October 7, 2025

Frankfort Honors Hickory Creek Middle School Girls’ Softball Team for Fifth State Title

Summit Hill 161 Sees Major Gains on State Report Card

Will County Board Committee Passes Contentious ‘Live and Work Without Fear’ Resolution on 4-3 Vote

Will County Awards $10.4 Million Contract for Bell Road Widening in Homer Glen Area

Meeting Summary and Briefs: Will County Public Works & Transportation Committee for October 7, 2025

Meeting Summary and Briefs: Will County Board Finance Committee for October 7, 2025

Meeting Summary and Briefs: Will County Board Capital Improvements & IT Committee for October 7, 2025

Meeting Summary and Briefs: Will County Board Public Health & Safety Committee for October 2, 2025

Will County Shapes 2026 Federal Agenda, Prioritizing Health, Housing, and Workforce Funding

Meeting Summary and Briefs: Will County Board Executive Committee for October 9, 2025